Digital data capabilities for portfolio companies

Report to fund managers and investors earlier with automated reporting for your portfolio companies.

Digital data capabilities for portfolio companies

Report to fund managers and investors earlier with automated reporting for your portfolio companies.

What we do

Consol offers financial close consultancy services and digital tools to companies, automating data sources and providing rapid information to their private equity owners.

Our strategies and digital tools have proven themselves in many different industries and are used by start-ups and corporates alike.

We will work together at investment level, fund level or management level to identify areas for improvement, develop strategies and define a ‘roadmap’ to a quicker month end in line with your starting point and industry specific benchmarks.

What we do

Consol offers financial close consultancy services and digital tools to companies, automating data sources and providing rapid information to their private equity owners.

Our strategies and digital tools have proven themselves in many different industries and are used by start-ups and corporates alike.

We will work together at investment level, fund level or management level to identify areas for improvement, develop strategies and define a ‘roadmap’ to a quicker month end in line with your starting point and industry specific benchmarks.

What to expect?

Our approach allows us to work with companies as one team, helping clients identify areas to improve, implementing solutions and allowing private equity owners to quickly respond to any necessary demands and report to investors.

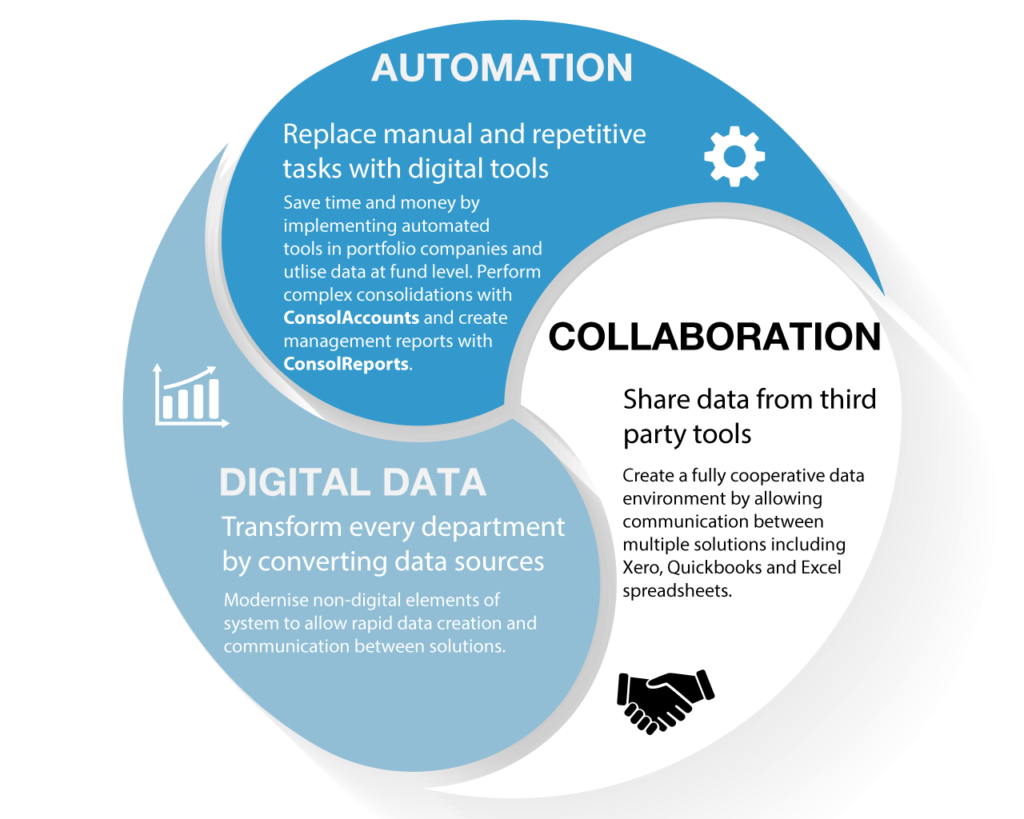

Our proprietary digital tools implement Consol’s 3 pillars of change; automation, collaboration and digital data; replacing manual tasks or increasing collaboration between existing data sources allowing key financial information to automatically flow up.

This result allows financial data and operating data to be seamlessly incorporated into fund analysis and reporting.

What to expect?

Our approach allows us to work with companies as one team, helping clients identify areas to improve, implementing solutions and allowing private equity owners to quickly respond to any necessary demands and report to investors.

Our proprietary digital tools implement Consol’s 3 pillars of change; automation, collaboration and digital data; replacing manual tasks or increasing collaboration between existing data sources allowing key financial information to automatically flow up.

This result allows financial data and operating data to be seamlessly incorporated into fund analysis and reporting.

Consultancy

ConsolConsult delivers professional advice and digital transformation to companies. Trusted by FTSE100 constituents, we provide a bespoke analysis of your investment company’s current data architecture and deliver strategic changes to unlock value by reducing month end.

ConsolConsult helps clients achieve:

- Starting point survey and goal design.

- Identification of target areas and common strategic delivery.

- KPI adoption ensuring delivery of shorter month end.

- Identification of appropriate digital solutions with customised elements eliminating risk of ‘tool proliferation.’

- Employee training in delivery and analysis of data.

- Sustained transformation, seeking continuous improvement.

How PE companies benefit

All in One Bespoke consultancy and tool adoption eliminates ‘tool proliferation’ and slashes unneccesary capital expenditures.

Cost Efficient Deliver value by integrating best working practices used by some of the country’s top companies to reduce costs.

Exit strategy Create accounting infrastructure that allows easy due diligence and builds trust wth buyers.

Valuation Multiples On-the-fly analysis of single investment, group, fund or management company allows quick valuations, management fee calculations or investor returns.

To find out more, please contact us.

Consultancy

ConsolConsult delivers professional advice and digital transformation to companies. Trusted by FTSE100 constituents, we provide a bespoke analysis of your investment company’s current data architecture and deliver strategic changes to unlock value by reducing month end.

ConsolConsult helps clients achieve:

- Starting point survey and goal design.

- Identification of target areas and common strategic delivery.

- KPI adoption ensuring delivery of shorter month end.

- Identification of appropriate digital solutions with customised elements eliminating risk of ‘tool proliferation.’

- Employee training in delivery and analysis of data.

- Sustained transformation, seeking continuous improvement.

How PE companies benefit

All in One Bespoke consultancy and tool adoption eliminates ‘tool proliferation’ and slashes unneccesary capital expenditures.

Cost Efficient Deliver value by integrating best working practices used by some of the country’s top companies to reduce costs.

Exit strategy Create accounting infrastructure that allows easy due diligence and builds trust wth buyers.

Valuation Multiples On-the-fly analysis of single investment, group, fund or management company allows quick valuations, management fee calculations or investor returns.

To find out more, please contact us.

Digital Tools

In adopting strategies recommended during the ConsolConsult phase, we help client IT teams source and adopt third party tools which compliment existing infrastructures.

Consol can also offer clients our own proprietary digital tools which can be customised to suit each individual business.

Our solutions include automated consolidation tools for groups, management reporting tools and visual KPI boardpacks.

How PE companies benefit

Digital portfolio Operating and financial data at investment level available at management level in as little as Day One after close with bespoke dashboard reporting.

Customisable Automatically incorporate investment company data and interpret information according to management needs.

Scalable Bespoke tools automate consolidation at company, fund or management level allowing agile deployment.

Automated capabilities Automate investor reporting, portfolio analysis, fundraising projections, valuation models, strategy planning, debt analysis and more.

To find out more, please contact us.

Digital Tools

In adopting strategies recommended during the ConsolConsult phase, we help client IT teams source and adopt third party tools which compliment existing infrastructures.

Consol can also offer clients our own proprietary digital tools which can be customised to suit each individual business.

Our solutions include automated consolidation tools for groups, management reporting tools and visual KPI boardpacks.

How PE companies benefit

Digital portfolio Operating and financial data at investment level available at management level in as little as Day One after close with bespoke dashboard reporting.

Customisable Automatically incorporate investment company data and interpret information according to management needs.

Scalable Bespoke tools automate consolidation at company, fund or management level allowing agile deployment.

Automated capabilities Automate investor reporting, portfolio analysis, fundraising projections, valuation models, strategy planning, debt analysis and more.

To find out more, please contact us.

Groups and acqusitions

Consol has specialised in providing consultancy services to companies and groups for over 30 years. Our digital tools are designed to automate month end processes including the consolidation of group accounts which has given us hands on experience with companies undertaking growth by acquisition strategies.

We help private equity management companies manage investments and report to investors earlier by efficiently bringing the month end reporting capabilities of multiple businesses under the same umbrella, delivering cost reductions and increasing return multiples.

Our tools help private equity management companies rapidly access key information from investments and interpret data automatically with any KPI or ratio required.

To find out more, please contact us.

Groups and acqusitions

Consol has specialised in providing consultancy services to companies and groups for over 30 years. Our digital tools are designed to automate month end processes including the consolidation of group accounts which has given us hands on experience with companies undertaking growth by acquisition strategies.

We help private equity management companies manage investments and report to investors earlier by efficiently bringing the month end reporting capabilities of multiple businesses under the same umbrella, delivering cost reductions and increasing return multiples.

Our tools help private equity management companies rapidly access key information from investments and interpret data automatically with any KPI or ratio required.

To find out more, please contact us.